Matthew Strelitz

Managing Principal at Radical Data, LLC

October 22, 2024

Executive Summary

Community banks, once an unassailable bastion of small-town America, are facing a critical juncture. On one hand, they face increased regulatory pressure, rising compliance costs, and persistent economic uncertainty. On the other, the rapid advancement of innovation, escalating competitive intensity, and heightened customer expectations are redefining how banking services are delivered. These forces have spurred M&A activity in the community banking space, with institutions increasingly using transactions to not only build scale and strengthen balance sheets but to acquire the capabilities needed to establish a defensible advantage.

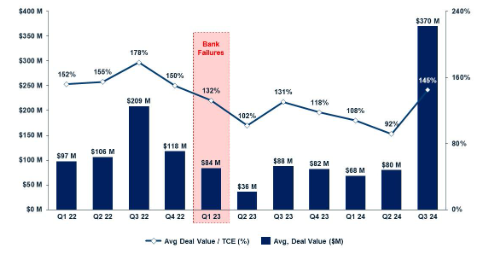

Community bank deals and total deal values have grown in 2024, with 55 deals representing a combined value of $5.5 billion announced through Q3. This upswing in activity reflects a broader shift for community banks, which have historically used M&A as a growth engine, to an increasing number using M&A to accelerate digital transformation and improve technology stacks that enable them to capture greater returns on technology investments. Looking forward to 2025, M&A activity is expected to follow 2024’s upswing, but the deals will get more complex, the stakes will get higher, and banks will need to be savvier. It’s not just about getting bigger; it’s about getting better.

Community Bank M&A Activity: Q1 2022 – Q3 2024

| Metric | FY 2022 | FY 2023 | YTD Q3 2024* |

|---|---|---|---|

| Number of Deals (actual) | 79 | 35 | 55 |

| Aggregate Deal Value ($B) | $6.9 B | $1.5 B | $5.8 B |

| Avg. Deal Value to Tangible Common Equity (%) | 158% | 122% | 118% |

Shifting Landscape Requires New Strategies

S&P Global Market Intelligence. Capital IQ Database. S&P Global, www.capitaliq.spglobal.com.

Data compiled Oct. 1, 2024.

Analysis limited to US-based depository institutions deals announced between 1/1/2022 and 9/30/2024 where the Buyer had total assets between $1 – $20 billion at the announcement date (terminated deals are excluded from the analysis)

It’s no secret that smaller banks are struggling to keep up. Between the looming specter of Basel III compliance standards set to take full effect in 2025 and ongoing updates to the FDIC’s merger review guidelines, community banks are caught in a regulatory vise that’s squeezing them harder than ever before. Meeting these heightened capital and liquidity requirements is going to be painful, unless they can find a way to share the burden.

That’s where M&A comes in. In 2024, the community bank M&A landscape was dominated by transactions designed to gain scale and distribute compliance costs. Deals like Camden National Bank’s $86.6 million acquisition of Northway Financial aren’t just about market expansion. Sure, Camden’s geographic footprint stretched further across Northern New England, and it got its hands on a $1 billion deposit base, but the real prize was the boost in capital it needed to prepare for the Basel III storm. Without that added heft, Camden would be scrambling to meet regulatory benchmarks or be forced to cut back on core services like lending. Instead, the bank’s balance sheet is fortified and poised to maintain its growth trajectory without missing a beat.

The numbers back it up: Camden expects its earnings per share (EPS) to rise by 15% in the first year following the merger, with another 10% boost expected in 2026. Its tangible book value (TBV) dilution was kept to a modest 2%, a win by any standard regarding these deals. For Camden, the acquisition wasn’t just strategic, it was necessary.

The Digital Race: Playing Catch-Up

Beyond the quest for scale, the need for digital transformation is reshaping the M&A landscape in community banking. Customers’ expectations for seamless digital experiences, whether transferring funds, applying for a loan, or checking account balances, have never been higher. Fintech firms, unburdened by legacy systems, have set a new standard for service delivery while technology giants are constantly delivering superior experiences that community banks simply can’t keep pace with. Digital disruption is no longer a future concern; it’s a pressing reality. Community banks need to modernize and fast. Building those capabilities internally isn’t just slow; it’s expensive and often means falling further behind.

Yet, the cost and complexity of building a competitive digital platform, complete with cybersecurity, advanced analytics, and seamless customer experience, can be prohibitive for community banks. For many, acquiring a bank with robust digital capabilities or merging with a tech-savvy competitor offers a faster, less risky path to digital transformation. This approach saves time and money while positioning the merged entity to better compete in a marketplace where digital convenience is often the deciding factor for customers.

Banks like Renasant Corp. are doing just that, buying their way into the digital age. Last year, Renasant shelled out $1.18 billion to acquire First Bancshares Inc., a Mississippi-based bank known for its digital prowess. Renasant wasn’t eyeing First Bancshares for its physical branches; it wanted its tech. The deal handed Renasant a suite of digital solutions, including mobile banking and AI-driven customer support, that would have taken years and millions of dollars to develop from scratch.

With First Bancshares tech under its belt, Renasant wasted no time launching a new digital loan origination platform. The payoff was almost immediate: loan application processing speeds jumped by 30%, operational costs fell by 12%, and customer engagement metrics surged. Meanwhile, the bank’s return on assets improved by 18 basis points, thanks to the efficiencies gained through digital integration. Renasant didn’t just buy a bank, it bought the future.

Valuation Trends and the Role of Credit Unions

M&A valuations in the community banking space have become a tale of two extremes. Banks with strong digital platforms are commanding sky-high premiums, while more traditional institutions are left struggling to justify their price tags. The median deal value-to-tangible common equity (TCE) ratio for bank deals announced in the first half of 2024 was 132.2%, but that’s just the median. Banks like First Bancshares and Northway Financial, with digital capabilities that complement traditional banking models, fetched much higher multiples.

One of the unexpected disruptors in this space has been credit unions. Long considered quiet players in the banking world, they’re now punching well above their weight in the M&A game. Credit unions are making aggressive moves with strong capital positions and a willingness to pay top dollar for banks that can enhance their digital capabilities or expand their geographic reach.

Camden National Bank. “Camden National Corporation and Northway Financial, Inc. to Merge” Camden National Bank, Sept. 10, 2024, www.camdennational.bank

S&P Global Market Intelligence. Capital IQ Database. S&P Global, www.capitaliq.spglobal.com.

Consider Global FCU’s $231.2 million acquisition of First Financial Northwest Bank. The deal, which marked the largest credit union-bank transaction in history, was driven by Global FCU’s desire to bulk up its digital infrastructure and tap into First Financial’s branch network. The credit union paid a premium 20% higher than the median deal value-to-TCE ratio for similar transactions, and it’s betting that this investment will pay off in spades. In the first year post-merger, Global FCU saw a 40% increase in its digital customer base, and its overall efficiency ratio dropped by 10 percentage points due to operational streamlining. For Global, the acquisition wasn’t just about growth; it was about digital dominance.

Challenges and Opportunities in the Community Bank M&A Landscape

But it’s not all smooth sailing. There are plenty of obstacles on the horizon that could derail M&A momentum. High valuations for digital-ready banks are creating mismatches between buyer and seller expectations, making it harder to strike deals. At the same time, the FDIC’s proposal to tighten its merger review process and the political pushback against large-scale consolidation could result in longer approval timelines and greater scrutiny.

Then there’s the problem of integration. Combining two banks is never easy, and the complexities only multiply when one or both have advanced digital platforms. A misstep in the integration process can turn what looked like a promising deal into a disaster. Talent retention, technology integration, and cultural alignment are the unseen landmines that can blow up even the most well-intentioned mergers.

Yet, for all the challenges, the opportunities are too good to ignore. Community bank CEOs know they need to get bigger and smarter to compete, and that means being willing to embrace the uncertainties of M&A.

Strategies for Success: What Community Bank Leaders Need to Do Now

To succeed in this environment, community bank CEOs and their boards must take a more strategic and disciplined approach to M&A. It starts with a clear-eyed view of what’s really driving value. A good deal isn’t just about expanding your footprint or bolstering your capital; it’s about acquiring capabilities that will matter tomorrow as much as they do today.

It’s also about getting the compliance side right. Engaging with regulators early and often can head off many of the issues that typically slow down deal approvals. Having a solid plan for integrating technology and managing cultural shifts is just as important. Success doesn’t happen by accident. The best acquirers treat M&A as a core part of their strategy, not just a tactic for growth.

M&A as a Launchpad — Not Just a Lifeline

The reality is stark: Community banks can’t afford to sit still. As digital disruption continues to reshape the financial landscape and regulatory demands increase, standing pat isn’t just risky; it’s a recipe for obsolescence. M&A has become more than just a means to grow—it’s a way to evolve, become more resilient, and gain the capabilities necessary to compete in an increasingly complex world.

For community bank leaders, the choice is clear. They can play it safe, and risk being left behind, or they can embrace the power of M&A to transform their institutions, build new capabilities, and position themselves for long-term success. For community banks, the future is there for the taking. Who’s bold enough to grab it?

Considering M&A? Let’s have a conversation

Contact Us: mstrelitz@radicaldata.net

If you’re ready to elevate your bank’s strategy and drive meaningful transformation, Radical Data is here to help. Connect with us to discover how we can support your success.

Learn More: www.radicaldatallc.com

Global FCU. “Global FCU Acquires First Financial Northwest Bank.” Global FCU, Oct. 8, 2024, www.globalfcu.org.